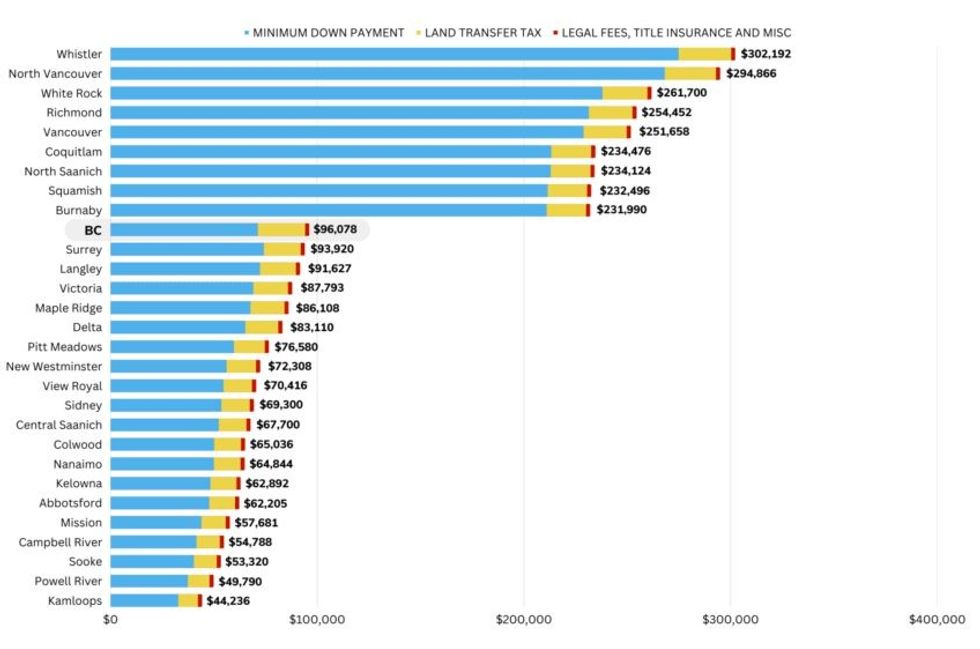

Finding the perfect home for you is one thing, but closing on it is another. You may have secured a mortgage for your house, but you still need to pay a significant sum on the day you take possession of it, including the down payment, the land transfer tax, title insurance, legal fees, and other miscellaneous costs, and how much you have to pay to close can vary depending on where in BC the home is.

To help out those that may be going through the process for the first time, Zoocasa published a report on Wednesday estimating how much money you need to close on a home across 28 cities in BC.

The biggest chunk of the costs is the down payment. To calculate the minimum down payments, Zoocasa used average home prices sourced from various real estate boards, dating to March 2023, where a 5% down payment is charged on homes with a purchase price of less than $500K; 10% on the portion of the price over that and up to $999,999; and 20% if the purchase price is over $1M.

Another big chunk of the closing costs is the property transfer tax. In BC, the property transfer tax rate is 1% for homes with a fair market value of up to $200K; 2% for homes with a value between $200K and $2M; and 3% for homes with a value greater than $2M.

Lastly, there are the costs associated with the title insurance, property tax adjustments, and legal fees, which can vary, but Zoocasa has set at a flat $2K for each of the cities.

READ: Homebuyer Confidence Returning in Greater Vancouver: REBGV

By those factors, the average amount of money you need to pay on closing day in BC is $96,078.

There is then a clear line of demarcation, with a group of cities with closing costs well over $200K and another group of cities with closing costs under $100K, and the key factor is the average home price. In cities such as Whistler, Vancouver, Richmond, and Burnaby, the average home price is over $1M, which means they are subject to a substantially higher down payment compared to cities like Surrey, Victoria, New Westminster, and Kelowna, where the average home price is under $1M.

However, the provincial government has a First-Time Home Buyers' Program, which grants those who purchase a home for $500K or less a full refund of the property transfer tax, and those who purchase a home for between $500K and $525K a partial refund, so first-time buyers could slash a significant portion of the closing costs.

Here is the full list and how the 28 cities stack up against one another: