Economic data since April “tipped the balance” of evidence that additional monetary policy tightening was needed.

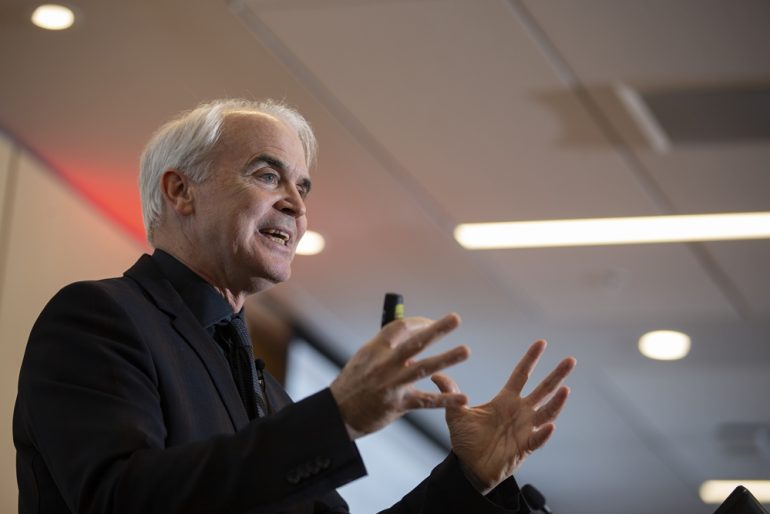

That was the assessment from Bank of Canada Deputy Governor Paul Beaudry during a speech in Victoria today when explaining Wednesday’s Bank of Canada decision to hike its benchmark interest rate by a quarter-point.

“The accumulation of evidence—across a range of economic indicators—suggests that excess demand in the Canadian economy is more persistent than we thought, and this increases the risk that the decline in inflation could stall,” he said. “That’s why we decided to raise the policy rate.”

Specifically, consumer price index inflation ticked up in April to 4.4%, while measures of core inflation (which strip out more volatile components such as food and energy), remain elevated between 3.5% and 4%.

“When we looked at the recent dynamics in core inflation combined with ongoing excess demand, we agreed the likelihood that total inflation could get stuck well above the 2% target had increased,” he said.

Beaudry also referenced the rebound in economic growth in the first quarter, which came in at 3.1%, high 5.8%-growth in consumption, “sharply higher” household spending on goods and services and the unemployment rate remaining near a record low.

Risks of a higher neutral rate going forward

Beaudry also warned that borrowers should be prepared for the possibility that interest rates could stay higher for longer.

He touched on what he described as “upside” risks facing the real neutral rate, or “the level at which short-term real rates should settle over time.”

“When households have a strong desire to save but firms have few investment opportunities, the neutral rate needs to fall to balance them out,” he said. “By contrast, when businesses have many opportunities for profitable investment, but households have little desire to save, the neutral rate is pushed up.”

He drilled down into some of the factors that could impact the savings rate, such as demographics, rising inequality and future investment opportunities. But the takeaway was that, in the Bank of Canada’s view, it is “more likely that long-term real interest rates will remain elevated relative to their pre-pandemic levels than the opposite,” Beaudry said.

Featured image: Christinne Muschi/Bloomberg via Getty Images