Posthaste: Canadians reporting insolvency hits record high just before Bank of Canada expected to hike interest rate

Third of people polled say they can't cover their bills and debt payments

Article content

Good morning,

In the week in which the Bank of Canada is expected to raise interest rates yet again a barometer of how Canadians are feeling about their finances is flashing red.

The quarterly MNP Consumer Debt Index out this morning showed that Canadians who report being insolvent have reached a record high.

More than half of the 2,000 Canadians interviewed for the survey conducted by Ipsos reported that they were $200 or less away from not being able to meet their financial obligations, up six percentage points from the last quarter.

This includes 35 per cent of respondents who said they already don’t make enough to cover their bills and debt payments, making them insolvent, the highest proportion since the index started five years ago.

“Battered by inflation and higher interest rates, a record number of Canadians say they can’t pay their bills and debt obligations each month,” says Grant Bazian, president of insolvency firm MNP Ltd. “The escalating burden of household bills and food prices has intensified Canadians’ financial anxiety — and is further compounded by increased debt-servicing costs, particularly for those who are deeply indebted.”

Since the Bank of Canada started to aggressively raise interest rates in March of last year Canadians have found their finances stretched further and further. The central bank hiked its rate from the pandemic low of 0.25 per cent to 4.50 per cent until pausing early this year.

The index that measures Canadians’ attitudes towards their debt and gauges their ability to pay their bills hit a low of 77 last December but then rebounded in March after the Bank’s pause.

Since then the Bank hiked another 25 basis points to 4.75 in June and the index has slid dramatically, shedding six percentage points to 83, reflecting that Canadians are feeling much worse about their finances.

The number of people saying they are feeling the effects of interest rate hikes has increased since the last quarter to almost 70 per cent. And about three in five Canadians say they will be in financial trouble if the Bank of Canada’s rate goes much higher.

The Bank will announce its latest rate decision this week on July 12, and most economists expect another hike, which would take the rate to 5 per cent. Strong jobs data (see below) on Friday seemed to seal the deal.

“The surge in employment in June suggests that another rate hike at the Bank of Canada’s meeting next week is nailed on,” Olivia Cross of Capital Economics said Friday.

If interest rates continue to rise, MNP expects Canadians’ pessimism about their finances will just increase.

Even though 86 per cent of the people polled said they were being more careful with their money, they are still finding it hard to make ends meet.

The average Canadian reports their weekly spending on essentials has increased by $230.

Even those of comfortable means are taking a hit. Households with income of $100,000 or more reported spending $310 more a week on essentials.

“Even if households are curbing discretionary expenses and spending more cautiously, many households have reached a point where there is nothing left to cut back on. They’ve already switched to the cheapest options at the grocery store and trimmed their entertainment costs — yet they still find themselves struggling with essential financial obligations like their mortgage or rent and putting food on the table,” said Bazian.

A breakdown of the survey reveals that Atlantic Canadians are feeling more pessimistic about their debt than any other province.

People here were the most likely to say they regret the amount of debt they’ve taken on, with the tally jumping 10 percentage points from last quarter to 57 per cent. Half are concerned about their current level of debt.

Ontario had the highest number of people reporting they were struggling financially. Fifty-four per cent of Ontarians reported that they were $200 or less away from not being able to make their financial obligations, including 38 per cent who said they already didn’t make enough to cover their bills.

__________________________________________________

Was this newsletter forwarded to you? Sign up here to get it delivered to your inbox.

_____________________________________________________________________

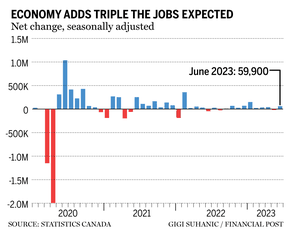

Canada gained another 60,000 jobs in June, triple what economists were expecting. The last significant data point before the Bank of Canada meets this Wednesday, the big gain will likely tip policy makers towards an interest rate hike, economists say.

“The data are probably just strong enough to see policymakers pull the trigger on another 25 basis-point interest rate hike next week, rather than wait until September as we had previously forecast,” CIBC economist Andrew Grantham said after the data came out Friday.

- 2023 summer meeting of Canada’s premiers in Manitoba

- Today’s Data: Canadian building permits for May, U.S. wholesale trade

_______________________________________________________

- The Iron City: An American outpost in the heart of Ontario cottage country

- Has Toronto’s housing rebound already peaked? June figures, rate hikes are cause for concern

- Howard Levitt: 10 years ago, I ditched my Ferrari in an epic Toronto storm and it’s still the first thing anyone asks me about

- One more Bank of Canada rate hike and then a ‘pause for the rest of the year’: What economists say about huge job gains

- LNG Canada aims to start shipping to world within two years

It’s easy to play it safe, but that doesn’t mean it’s necessarily the wrong strategy. Portfolio manager John De Goey says what’s needed is an accurate self-assessment to figure out your risk tolerance (how well are you sleeping?) and risk capacity (how long can you withstand a market downturn?). Here’s how you do it.

____________________________________________________

Today’s Posthaste was written by Pamela Heaven, @pamheaven, with additional reporting from The Canadian Press, Thomson Reuters and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at posthaste@postmedia.com, or hit reply to send us a note.

Postmedia is committed to maintaining a lively but civil forum for discussion. Please keep comments relevant and respectful. Comments may take up to an hour to appear on the site. You will receive an email if there is a reply to your comment, an update to a thread you follow or if a user you follow comments. Visit our Community Guidelines for more information.