Renters in majority of Canada's major cities cannot afford to purchase a starter home: study

A new report on Canada’s real estate market is offering a discouraging reminder of just how out of reach homeownership is for many British Columbians.

With the skyrocketing home prices and increasing mortgage rates, a growing number of renters in major cities are now unable to afford to buy a starter home.

Data from Point2 Homes is serving a harsh reality check for those hoping to get into the market.

Buyers have long moved south of the Fraser River in order to afford their first home, but it appears that strategy may no longer work.

“The Fraser Valley benchmark price right now for condos is $542,000,” said Caileigh Anderson, a real estate agent with REMAX Treeland in Langley.

Anderson says buyers need to earn $115,000 a year to qualify for a $500,000 mortgage.

The realtor says it’s a particularly tough time to be a first time buyer because it’s now much harder to qualify for a mortgage and save for a down payment.

“Prices have increased substantially over the last couple of years. Therefore, your down payment money needs to increase the amount of property transfer tax you have to owe increases,” said Anderson.

The Bank of Canada has also taken the unprecedented step of increasing interest rates nine times since March 2022.

The government does have an incentive for first time homebuyers with property transfer tax, but the home has to be $500,000 or less.

“Where we live here in Vancouver and the Fraser Valley that's very challenging to find,” said Anderson.

According to the Point2 Homes report, renters in 36 of Canada's 50 largest cities earn 60 per cent less than what’s required to own a starter home.

Three quarters of those cities have no, or very little starter home inventory at all.

Langley, Surrey, and Abbotsford have the highest stock of starter homes in the Lower Mainland, but demand is high, so not much is available.

“They always are going to have a high demand due to affordability for first time homebuyers. But the second reason is that you're also dealing with investors at that price point range, because that's the range where you pretty much have a chance of breaking even,” said Anderson.

In Langley, entry level homes make up just 14 per cent of the inventory.

Starter homes are traditionally small in size and priced around $200,000.

However, you’re unlikely to find those prices anywhere in Metro Vancouver.

“Forty or 50 years ago, I think most people would think of a starter home, as, you know, white picket fence, single detached house, somewhere near the city center. Of course, today, a home like that is going to cost quite a lot of money,” said Andrew Lis, the director of economics and data analytics at the Real Estate Board of Greater Vancouver.

The definition of an entry-level home has changed in today's pricey housing markets.

Now, they’re defined as the first home a person owns, regardless of its size or price.

“If you're looking for a kind of the entry level price point, it's probably around $600,00 to $700,000 is the average price in the Vancouver region,” said Lis.

The survey found renters in Richmond, Vancouver, Coquitlam, Burnaby, Surrey, Langley, and Abbotsford cannot afford to purchase a starter home.

Lis would like to see the provincial government do more to help people get into the market.

“Renter households who are paying more than 30 per cent of income on shelter costs, it can take up to five to six years or so just to save up the amount for the property transfer tax that they're gonna have to pay on the purchase of a starter home. So the government has a program in place that they could fix by adjusting the threshold to more reflect the greater realities of what a starter home costs these days,” said Lis.

Anderson says some buyers have given up.

“This year alone, I've had three separate clients, couples that just moved out of province, they're like, we can't, we can't afford this anymore. You know, our cost of living is just too high,” said Anderson.

She says there are creative ways to get into the market though.

Co-buying with a partner, friend, or a family member is becoming increasingly popular.

“Then you share the cost of the living expenses, and also the down payment cost,” said Anderson.

She says quite a few parents are even giving their children money by taking equity out of their home that they're living in.

However, she warns people to do their homework first.

“Just being really clear on what co ownership would look like in terms of who's splitting the costs. What happens if I want to sell or move on?,” said Anderson.

Another tip she’s offering is buying an investment property elsewhere in Canada like Alberta or Saskatchewan where home prices are cheaper.

“Then you've got someone else paying off a property for you somewhere else,” said Anderson.

If the property appreciates, she suggests selling and taking that equity to buy where you actually want to live.

CTVNews.ca Top Stories

'A beautiful soul': Funeral held for baby boy killed in wrong-way crash on Highway 401

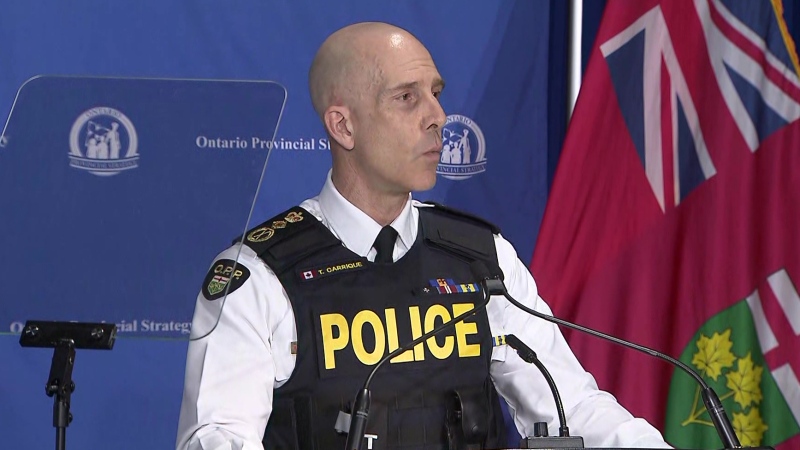

A funeral was held on Wednesday for a three-month-old boy who died after being involved in a wrong-way crash on Highway 401 in Whitby last week.

'Sophisticated' cyberattacks detected on B.C. government networks, premier says

There has been a "sophisticated" cybersecurity breach detected on B.C. government networks, Premier David Eby confirmed Wednesday evening.

Police handcuff man trying to enter Drake's Toronto mansion

Toronto police say a man was taken into custody outside Drake's Bridle Path mansion Wednesday afternoon after he tried to gain access to the residence.

Biden says he will stop sending bombs and artillery shells to Israel if they launch major invasion of Rafah

U.S. President Joe Biden said for the first time Wednesday he would halt shipments of American weapons to Israel, which he acknowledged have been used to kill civilians in Gaza, if Prime Minister Benjamin Netanyahu orders a major invasion of the city of Rafah.

Canucks claw out 5-4 comeback win over Oilers in Game 1

Dakota Joshua had a goal and two assists and the Vancouver Canucks scored three third-period goals to claw out a 5-4 comeback victory over the Edmonton Oilers in Game 1 of their second-round playoff series Wednesday.

Nijjar murder suspect says he had Canadian study permit in immigration firm's video

One of the Indian nationals accused of murdering British Columbia Sikh activist Hardeep Singh Nijjar says in a social media video that he received a Canadian study permit with the help of an Indian immigration consultancy.

Pfizer agrees to settle more than 10K lawsuits over Zantac cancer risk: Bloomberg News

Pfizer has agreed to settle more than 10,000 lawsuits about cancer risks related to the now discontinued heartburn drug Zantac, Bloomberg News reported on Wednesday, citing people familiar with the deal.

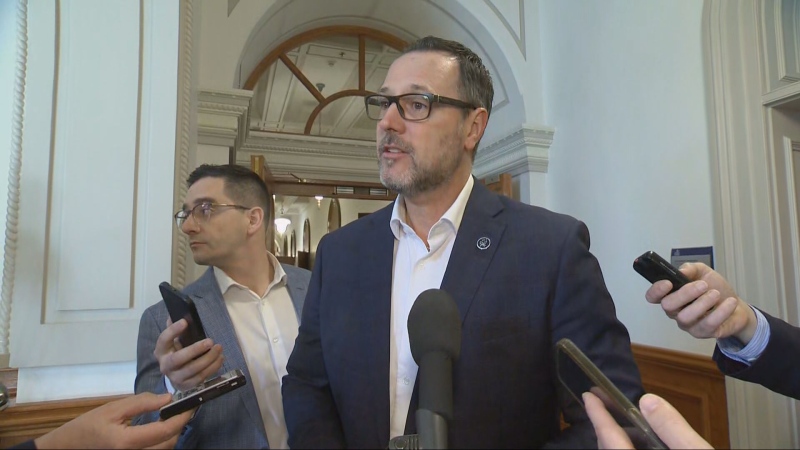

Quebec premier defends new museum on Quebecois nation after Indigenous criticism

Quebec Premier Francois Legault is defending his comments about a new history museum after he was accused by a prominent First Nations group of trying to erase their history.

U.S. presidential candidate RFK Jr. had a brain worm, has recovered, campaign says

Independent U.S. presidential candidate Robert F. Kennedy Jr. had a parasite in his brain more than a decade ago, but has fully recovered, his campaign said, after the New York Times reported about the ailment.